Part V: When the Growth Imperative meets Planetary Boundaries

- Brianna Welsh

- Dec 23, 2022

- 20 min read

Updated: Jan 29, 2023

In a continuation from the Growth Imperative post, here I examine on the precarious precipice of continued consumption -- how the indefinite commodification of a planet with finite resources exposes us to inevitable long-term societal suffering. Attempting to unmoor the conversation from ideological or political beliefs, this thought piece is strictly focused on the current and extrapolated realities of an exponential materials economy derived from a linear resource economy.

While the intricacies of an “Energy Transition” may not be fully comprehended by most who demand it, the concept of renewable energy to transition off of hydrocarbons is most certainly in the zeitgeist. We are fed this sense that fossil fuels are dirty and renewables are clean and the planet is choking so we need to make the change. But outside this massively reductive narrative, I’m not sure many of the people appealing for this transition really have a clue what that actually means. It’s understandable that the physics, geopolitics and economics of energy is not something the average person spends their days philosophizing about, but energy literacy is disconcertingly low considered its leading role in our global play. In a world entirely fueled by energy, we are going to need to get a lot smarter about how we discuss the problem of energy if we are ever going to solve it.

Energy Scarcity

Admittedly, events in 2022 have shifted our attention on energy, dramatically. The militarization of energy supply by Russia has thrust energy into the global spotlight, a wake-up call from the comfort zone of industrial civilization. Until this summer, only a few fringe energy experts really ever cried a foul on the very real risks of our planetary limitations and the energy infrastructure we have taken for granted. From energy shortages and heating blackouts in Europe, to famines in Africa from commodity obstruction, the market dependency on energy is becoming acutely obvious. The global economy crippled by the war of one man, weaponized energy supply has disrupted trade and food and fuel, shocks of which directly reverberate into the average person’s home. And as one of the world’s largest economies is stifled, the trickle-on effect is felt at greater magnitudes in more vulnerable places, where survival has historically depended on the social nets of financial powerhouses like the European Union, now struggling to support even their own.

But as painful as all of this is, it is indeed, a temporary “shock”. Nations stuck scrambling to troubleshoot, but there still is a Plan B. The energy crunch of 2022 not the result of true resource scarcity, merely artificial constraints imposed by a singular hostile nation. Padding the accounts of Russia’s kleptocracy, funding Putin’s imperial ambitions, and staving off international intervention, energy scarcity this year is, while devastating and brutal, still entirely political.

But what if Europe’s energy shortage is a canary in the coal mine for a future of real resource shortages? What happens if the energy constraints in Europe or the food shortages from the Ukraine are not due to a (hopefully) temporary punitive war, but because we have permanently depleted resources? Where the price of petrol and grains became so unattainable, economies simply buckle under the pressure. A snapshot into the future, the energy crisis in Europe feels to me like a rehearsal for the theatre of real global resource scarcity. Species extinction might be far off still, but the social unrest due to essential supply shortages will hit political amplifiers long before any land is actually inhospitable. As we are seeing with the protests in Europe to acquiesce to Putin’s dominion, desperation is dangerous.

Energy 101

So why is energy just so important? Why are wars fought over oil and countries held hostage for their natural resources?

Leaning on grade school science trivia, I want to remind you that everything in the world requires energy to function. Energy is entirely intrinsic to all life forms. All animate (biological) and inanimate (industrial) systems require energy to do, well, anything. Harvesting energy from our environment as an entropy pump, transmuting exosomatic energy into endosomatic power, is what makes us alive. As economist Steve Keen explains, “a human without energy is a corpse, technology without energy is a sculpture, and a city without energy is a museum.” This is why energy is such

a critical (yet frequently overlooked) matter for the survival and thriving of civilization.

Extending this law into our economy, energy is similarly essential for the functioning of our markets. The market is nearly 100% tethered to energy, meaning a 1% rise in global GDP is accompanied – or technically, is fueled by – a 1% rise in energy consumption. Our economic stories assert that all we need is money to create more growth, prosperity, etc. But while we can create money, we cannot create the energy that that money

claims. We can only transmute energy, by extracting, burning and building, as energy is the only input that has no other inputs besides other energy. Energy comes from the extraction and processing of natural resources, which explains why history has been littered with territory wars for the most mineral-and-resource-rich lands. Energy consumption rises in proportion to the complexity of a system, which means that the increasingly complex interconnectivity of our global economy, will only continue to trend upwards in its demand for energy. So the inconvenient truth for most economists is that, natural capital, not financial capital, is the true foundation of our economic systems. Money is, as economist Nate Hagens writes, a “direct claim on energy and resources”.

Environmental Exhaustion

As dissected in the Growth Imperative post, we have outsourced the planning of our ecologies to the financial systems, optimizing for more dollars at the expense of less nature. This is why every dollar that transacts in the world, something like $100 trillion dollars every day, has environmental externalities, but the social and ecological impacts of that economic activity have pretty much been disqualified from our market pricing system. The market hasn’t (effectively) been asked to pay for the damage done in accessing the inputs required to fuel our economy, nor the outputs following our consumption (the environmental toxins that poison our air, oceans and ecosystems). The market only bills us for the cost of extraction. Both resource depletion on the front-end and pollution on the back-end of material production are externalized to nature’s balance sheet, at a cost of $0 to the market. Deemed “‘external’ to the engine that is our money economy, the mess our market makes has largely been considered someone else’s garbage to clean up. Not bound by ethics, the embedded growth obligation suppresses any wisdom constraint, any check-or-balance causing reflection on the deleterious implications of this system. Unsurprisingly, if the market were to be priced appropriately with companies asked to pay for the true cost of their products, not a single industry would be profitable.

Propelled by a cult of exponential growth, the modern market system and its diligent servants – the technosphere – respects no physical or ecological limits. With a primary purpose of replacing the natural world with artificial environments supported by high-energy inputs, the technosphere professes that there is a technological solution to every social, spiritual, political and ecological problem. The technosphere requires a constant increase of energy to manage its byzantine operation, and an exponentially growing landfill to dump all of its waste.

This has gone okay for a couple hundred years, when nature’s dumpster had some spare room. But much like maxing a credit account with frivolous spending, we are now approaching Earth’s limit. We are now threatening that fateful point where the exponential curve of the growth imperative and the linear one of the materials economy meet. But unlike banks who can (theoretically) extend a higher credit line or the Fed gratuitously printing its way out of debt, nature has a fixed cap. We are exploiting faster than ecosystems can reproduce and polluting faster than they can absorb. Mother Nature is getting tired of running our exponential financial economy while we desolate her linear materials one. Planetary boundaries, it turns out, are not all that flexible. As a genocide of negligence, nature is always at the behest of the market.

Now I don’t imagine that the timeline of environmental exhaustion is news to most people in 2022. The familiarity with the ecological destruction predominately attributed to by our economic systems, has become somewhat mainstream; the models of our climate risks like extreme weather patterns and inhospitable lands fueling mass migration are pretty-well-documented. The ocean acidification, coral loss, oceanic dead-zones from nitrogen run-off caused by harmful agricultural practices, deforestation, microplastics poisoning our aquaculture (and our bodies), biodiversity loss, pollinator loss, erosion of topsoil, over-fishing – all of which directly interfere with our biological basics – preoccupy our daily news.

But admittedly, these models feel far out in the distant future. When we talk about climate refugees, we generally speak in decades or centuries – timelines that are often incompatible with our dopamine-addicted-instant-gratification-monkey-minds, anchoring us in behaviours of master procrastinators. Our evolutionary neurochemical cocktails are not programmed to concern ourselves much with the distant future. Climate always feels like tomorrow problem, so we’ll clean up our house another day. Just kicking the can down the road, we live in a world of hyperbolic future discounting.

Energy Slaves

To understand the implications of the growth imperative’s extractive economy however, requires a clear understanding of the physical consequences of energy systems and the concatenation of events of leading up to nature’s credit limit. When a few mildly intelligent apes stumbled upon the vast energy surplus of hydrocarbons stored underground, a Cambrian explosion of fossil-powered innovation ensued. A giant energy battery stored beneath Earth’s surface, this sequestered power source conferred energy benefits orders of magnitude greater than any human-powered energy system previously. This new discovery of geologically ‘stored sunlight[i]’ in the form of coal, oil and gas changed everything. Fossil energy has the potential to do 700,000 watt hours of work per day, compared to a mere 600 watt hours for a human day, meaning that 1 barrel of oil does around 5 years of human manhours work. This works out to a ratio of about 500 billion[ii] human equivalents in oil, relative to 5 billion labouring humans. Imagine those giddy industrial revolution apes who struck gold on the evolutionary time scales. We can’t really blame them for throwing a carbon party.

Today, we are the only animal that uses energy exo-somatically. Humans consume about 2000 calories per day in body, but an additional 200,000[iii] calories per day, extra-corporeal. All made possible because we discovered these stored hydrocarbons. Our world now runs on about 19 Terawatts of power – a 7.7 billion person ‘Superorganism’ with a 19 TW metabolism that far exceeds our individual human capacity.

This concept of the massive subsidization of human economies by fossil fuels was first highlighted by Buckminster Fuller in his description of ‘energy slaves’. A global labor-force of fossil armies augmenting human capacity, Bucky saw that coal, oil and gas were batteries for ancient sunshine that allowed civilization to, for the first time, live beyond its natural solar income. This is basically what allowed for us to grow our global population 16x from around 500 million 200 years ago, to 8 billion since the industrial era. Most of the labour done in our modern economy is performed by our fossil armies, thousands of times cheaper than human ones. This captive energy source grants us the freedoms and luxuries we live today, bringing billions of humans into existence and billions more out of poverty. In that sense, we are indentured servants to the fossil gods.

But this energy windfall also led to the creation of new stories, institutions, and expectations. While our ancestors' lives were tightly linked to the natural flows of the Earth - the sun, the rain, and the soil – we were suddenly impervious to nature’s limitations. The main inputs to our economies were now mostly free – we merely had to pay for the cost of their extraction, not the cost of their creation, their true worth, nor their pollution. As Hagens writes, “to our ancestors, the benefits from carbon energy would have appeared indistinguishable from magic”. We increasingly replaced manual human tasks with machines, at a fraction of the cost and dramatic speed. The result was higher profits, higher wages and cheaper goods. Sudden access to this bank account of stored carbon energy turbocharged our populations and quadrupled our economic growth rate.

But we are now “drawing down this energy battery 10 million times faster than the daily trickle charge of photosynthesis of Earth. Our economic system treats this battery as interest rather than principle, but as there is no substitute for energy other than another form of energy, when we run out of this cheap energy at scale, we will have serious problems. We take for granted being able to have the attributes of demigods by using an irreplaceable substance as if it were unlimited. The value of fossil armies is the biggest blind spot in human economics.”

Gross World Burning (GWB)

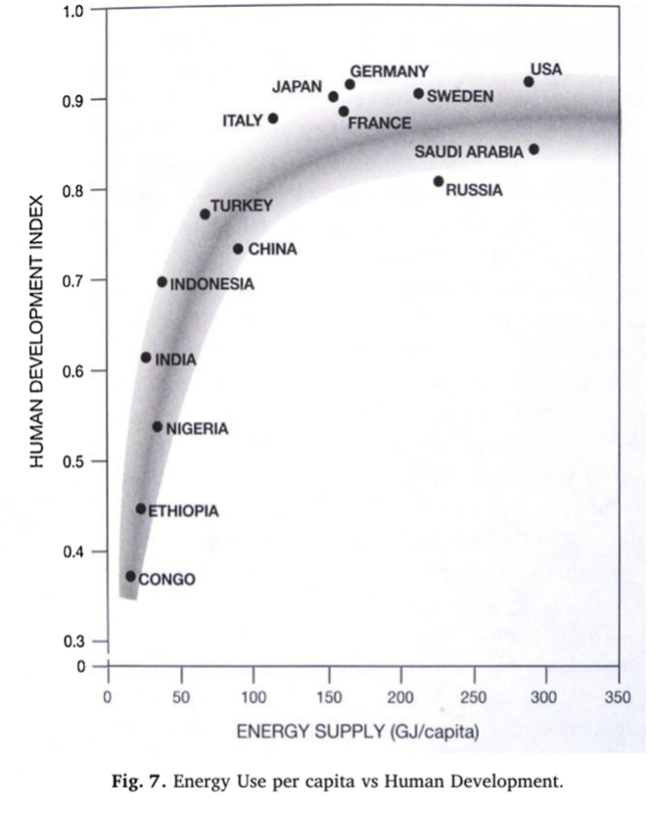

At its core our culture has a flawed macroeconomic model. While we identify that energy consumption is a pro-growth variable, meaning that the increase in energy consumption causes a corresponding increase of economic growth – a country’s success is almost entirely correlated to its consumption of energy – we have not quite acknowledged or accepted the relationship between energy, technology and the economy. The energy-credit-growth dynamic is possibly the least understood but most important phenomenon driving our current global geopolitical and ecological dynamics.

In the post on the Growth Imperative, we already established that GDP is a poor metric of our collective well-being and cultural progress, but it is however, a reasonably good metric of how much energy humans burn: “GWB –Gross World Burning”. As GDP increases globally, energy generally increases in lockstep. The whole human system is still nearly perfectly tethered to energy, 84% of which, comes from fossil fuels. While it’s true that energy and GDP has decoupled in some countries since around the 1970s, particularly in service-based economies like the US and the UK (due to “efficiency improvements”) it’s important to consider the macro level of the materials economy. If Western countries are simply outsourcing their high-energy-intensity production to far corners of the world and then importing the goods they produce, the net effect on the Planet Earth is the same. In a globalized world, GDP should be a global metric; national metrics on global supply chains are gibberish. As Daniel Schmachtenberger states: “it’s cooking the books while cooking the planet”. Comparable to claiming a high Gini coefficient when the products you need to exist are still imported. You’ve simply exported cheap labour elsewhere. What looks like a local improvement is merely externalizing harms somewhere else. Countries don’t depend on themselves, they depend on six-continent global supply chains, including the commons of the oceans and trees and minerals. National GDP as a metric is a bigger-than-Enron energy accounting scandal.

Speaking of energy efficiencies, even if they did truly materialize, the Jevon’s Paradox asserts that increases in efficiencies actually predict greater consumption patterns, rather than less. 19th century British engineer William Jevons identified that more efficient steam engines resulted in more consumption not less. Efficient steam engines accelerated coal consumption as more industries found more uses for steam engines. Projecting into current day, a group of MIT researchers recently looked at 57 cases of dematerialization, questioning whether these products resulted less resources and energy extraction. They found that Jevons’ Paradox ruled, totally. More efficiency just led to more spending. The dematerialization of products means that people can afford things they could not before. Given the embedded growth obligation, we will naturally evolve to extract any residual energy and capture profit potentials. This means that efficiency benefits don’t matter.

Notice that to date, solar and wind energy haven’t retired a single fossil fuel because they have primarily been used to supplement additional energy expenditures. In fact, the amount of growth in global electricity demand from 2018-2019 alone was more than the entire solar PV capacity installed since it was invented. It is bewildering to me that the world hasn’t seemed to draw the Jevon’s conclusion. It is no secret that despite rapidly scaling renewable energy, we have not slowed our CO2 emissions. Expanding renewables doesn’t matter if we expand consumption in direct proportion.

To offer an illustrative parallel to help explain this phenomenon, the growth obligation is so consuming, so terminal, that it behaves like a cancer. Exploiting all energy in a system before it hits a cliff, a cancer reaches the peak number of cells in a human body right before the body dies, and the cancer with it. It is by definition, self-terminating. This is exactly like the human impact on the biosphere. The only way to short-circuit the feedback loop of reinvesting profits into building and consuming more, is to have a requirement to reinvest efficiency gains into protection or restoration.

Diminishing Returns on Energy

Another oft-overlooked obstacle for the growth imperative and its associated energy consumption, is that we have already reached diminishing returns on energy investment (EROI). We peaked in our oil exploration and extraction around about the 1950s, meaning all extraction since then has required more energy and more dollars to extract. High-quality, easily-accessible ores and energy deposits are now mostly things of the past. The effort and cost to obtain the remaining energy stores basically takes the meal off the menu. Just like a lion getting a different calorie payoff for an antelope vs a bird, we get vastly different benefits to society from drilling 21 meters below ground to find a Texas gusher, or squeezing oil from the sands of Alberta. A profound reckoning, this energy depletion will act as a growing tax on human societies that we are simply not accounting for.

This EROI is going to cause problems for our plans to grow. The 10 billion at mid-century are going to want energy. But with rising oil extraction costs, we won’t be able to increase global wattage over the next two decades in line with the growth in demand. The International Energy Agency asserts that with no new drilling, world oil production would be cut in half by 2025 and to only 15% of today’s output by 2040. Presumably we will invest in new oil fields, but doing so will require a higher oil price, driving down economic growth. Today in Europe, energy prices are 15-20 times what they were 18 months ago so we’re already feeling the squeeze, albeit, a temporary one. But as the extraction of geologically stored energy becomes increasingly difficult, modern comforts will become more costly or potentially completely unavailable. A global movement towards sustainability may eventually change the low price elasticity of demand for oil, but while the energy transition continues apace it's important to understand how supply and demand factors influence the price of oil and therefore the wider economy.

As a renewable energy person, you might be wondering why I am referring almost exclusively to fossil fuels. The thing is, oil is basically in everything. As we have seen with the implications of transporting wheat from the Ukraine, it impacts the price of just about everything. An increase oil price will not only be seen at the gas station, but it will be felt in virtually all the goods and services we use. Every time natural gas prices go up, food prices join the ascent. Making fertilizer is an energy-intensive process, and right now, half of the world’s crops depend on these fossil fuel-based nitrogen inputs. This is one of the reasons why the head of the Commodity Futures Trading Commission (CFTC) recently stated: “it’s abundantly clear that climate change poses a financial risk to the stability of the financial system”. Equally, the International Energy Agency (IEA) writes that our “future economic stability is hinged on reversing the slide into energy poverty”. Our relationship to energy has thus far been primarily one of unfettered extravagance. As Hagens writes, “a bunch of mildly clever, highly social apes broke into a cookie jar of fossil energy and have been throwing a party for the past 150 years. But the party is about over and when morning comes, radical changes to our way of living will be imposed. Some of the apes must sober up before morning and create a plan that the rest of the party-goers will agree to. But mildly clever, highly social apes neither easily nor voluntarily make radical changes to their ways of living. And so coffee and stimulants (credit, bank bailouts, papering over real shortages, etc) will be consumed during another lavish breakfast, but with the shades drawn. It’s morning already, and eventually they’ll need to face the light.”

But what about renewable energy?

We’ve been collectively talking about this climate change thing for quite a while now, and the migration towards renewable energy has been hailed as the panacea for our climate problems. While a major pollution step-improvement over hydrocarbon emissions, the whole renewables conversation is a great deal more complex than just turning off the fossil taps and plugging in solar panels.

So I do want to shed a bit of physics-reality on the renewables conversations:

First, we must quantify the potential output of oil compared with the potential output of renewables, to understand what can be replaced and what cannot. Renewable energy is converted primarily into electricity, yet the world is not currently electrified. Electricity accounts for only about 20% of what oil is used for today. So we could in theory, replace that 20% with renewables, but that doesn’t address the remaining 80% at all. We first need to shift away from petrol-consuming industries, transportation being the obvious first, but even if the entire planet converted to electric vehicles tomorrow, that would still only account for another 26% of all oil consumed. In fact, gasoline used for transportation is only 40% of a barrel of oil, with the remainder used for heating oil, diesel, asphalt, tires, plastics, fertilizers, makeup etc. (more than 6000 other products). So even if we could conceptually replace all internal combustion cars with electric vehicles, it wouldn’t reduce demand for oil, it would only reduce the demand for gasoline. What would we do with that gasoline - dump it in the oceans? Burn it, polluting the air and seas? Additionally, many things we do with hydrocarbons (like liquid fuels, heating, shipping, and heavy manufacturing) are hard to replace with carbon-neutral materials, or impossible to electrify. We cannot make the fertilizer mentioned above with renewables, so as a discrete example, what then, happens to the global food supply if we just cancel natural gas? We can certainly reduce our demand for oil and gas, but as of today, we cannot eliminate it without serious downstream consequences, the product of which, will immediately impact every human on earth.

Second, renewables are expensive and energy intensive to build. Producing wind turbines and solar panels requires a lot of energy, which today is coming from hydrocarbons. The inputs of these renewables (the PV cells, for example), require the mining of minerals, many of which, are non-renewable themselves. The IEA tells us that with the current level of innovation, an electric car requires six times more mineral inputs than a conventional car. And to meet the demand for renewable inputs, the World Bank projects global production for minerals such as graphite and cobalt will increase by 500 percent by 2050. Offshore wind turbines each require a 4 tonne magnet, copper wire for electricity transmission and plastic propellers. Using pure electricity to go deep into the mines for these minerals is highly inefficient and expensive, so as of today, all the materials required to make wind turbines and solar panels use oil to extract, or in the case of the plastic blades, are directly made from oil. Solar and wind, while harnessing the indefinite sources of natural energy, are converting that energy using machines produced by materials and must be rebuilt and disposed at the end of their lives. Renewables are as Hagens says, really re-buildables, requiring massive amounts of energy and materials to construct and maintain. Every form of energy comes with an ecological cost and has physical limits. Unfortunately there is no such thing as “clean energy”, nor truly “renewable”.

Lastly, renewable energy quality is not as dense or consistent as hydrocarbons, meaning we need more renewable energy installations per hydrocarbon plant. The energy return on renewables of solar and wind is about 4:1 if you handicap for variability, compared with an 8:1 return on coal is 8:1. Our economic system couldn’t function at 4:1 return, which means we need to overbuild renewables (sometimes 2-3 times) to generate the energy we need to boost the full system EROI to 6:1. It is physically viable, but economically far less attractive. Without massive subsidies, the full deployment of intermittent renewables like solar and wind will be highly unlikely.

Just to be clear, I am not supportive of continuing with oil and gas, their ecological effects are indisputable. Net net, the shift to “re-buildables” is both necessary and inevitable, and I strongly advocate for this transition. But what I do want to illustrate, is the complexity of our energy and economic systems, and that accompanying this transition will be a lot of other “externalities” and challenges to consider, that I feel we collectively willfully ignorant to. Also that while a transition to clean-er energy is a net positive, it is also insufficient for our world to “eliminate oil”. We need a sense of pragmatism infused in this climate conversation, one that takes a macro systems view of the realities of our economic engine and the Superorganism’s metabolism that is our 7.7 billion.

The politics of planetary boundaries Our modern economies have advanced and grown for two centuries through the gigantic blind spot of fossil fuel exploitation and its unintended consequences. We are heading towards a decarbonization trajectory that may end up undermining ecological integrity and heighten the risks of conflict and insecurity, the consequences of which will reverberate worldwide. “Corruption, institutional and socioeconomic fragility, climate disruptions and environmental plundering, all acting as a backdrop to a competition to gain access to the minerals that we need in order to decarbonize”.

Let me explain. History tells us that power dynamics change as energy dominance does. Remember how the coal energy transformation made Britain the wealthiest nation on Earth and ruler of the largest empire in history? Or how the US earned its superpower status with its discovery of oil? And with the Ukraine being a resource-rich territory, it seems no coincidence that Russia wanted a piece. Especially in light of the deal struck with the EU to diversify supply chains for critical raw materials, helping the EU decarbonize and reduce dependence on Russia. And then recognize that today, the EU is 98% dependent upon China for rare earths. And that they produce 80% of wind turbines and 60% of solar panels. It is no accident that the countries that can harness and transform energy, do the same for their power. Like its coupling to GDP, energy ownership materializes into geopolitical power as well.

As the climate clock is ticking and we race for a new generation of power, the resources required to decarbonize might tilt the scales of economic power as well. The Notre Dame Institute tells us that many countries that are climate vulnerable are also the ones that are resource-endowed, possessing vast mineral deposits beneath their crust. They are also coincidentally the ecosystems that we need to protect and regenerate in order to stabilize global ecosystems. To reboot the natural regeneration and to protect biodiversity. So considering the minerals required to shift course to renewables, countries who happen to sit on large deposits are likely to play a greater role in the global economic arena than ever before. While embedded deposits are scattered throughout the world (Chile and Australia sit on lithium, Congo has cobalt, and ASEAN island nations run nickel), China pretty much dominates the processing of every key mineral, from material such as lithium to nickel to cobalt. An impressively long-termist regime, the CCP’s neocolonialist Belt and Road Initiative is certainly no accident. China understood long ago that natural resources would play a central role in the global race to growth, and check-mated America decades before America even knew it was playing the game.

We are not exempt from nature’s laws

The point I wish to make in this piece, is that if you’re focused on climate change and not focused on the economic relationships it requires, or frankly, how to prevent WWIII, you are going to be a problem. Climate change action or environmental protection is not just going up against the oil industry, it is going up against the global market itself. There are no industries that don’t need energy, and climate change action is making energy more expensive. Which means that, unlike canceling cigarettes or HFCs, hydrocarbons are at the heart of macroeconomics itself. The vested interests are literally, everyone.

The optimistic conclusion I take from this though, is that we don’t so much have environmental or energy problems per se, but we have a consumer growth problem. As long as GDP is our goal, efficiency gains from new technology will serve the superorganism. The insatiable Superoranism has an imperative to grow to feed its financial commitments, or the system will crash. Today we have economies that need to grow, whether or not they make us thrive: what we need are economies that make us thrive, whether or not they grow.

For decades, the environmental movement has been telling us, “we are not exempt from nature’s laws.”

The ascent of humanity to overlordship of the planet has also played a central role in the dissolution of our bonds to nature and community. In response to the constant call for more growth, we should maybe start asking: ‘growth of what, and why, and for whom, and who pays the cost, and how long can it last, and what’s the cost to the planet, and how much is enough?’

Joseph Schumpeter wrote in his 1954 History of Economic Analysis, “in practice we all start our own research from the work of our predecessors, that is, we hardly ever start from scratch”. “Maybe we need to must learn how to discard old ideas, how and when to replace them … how to learn, unlearn, and relearn”, wrote the futurist Alvin Toffler. But suppose we did start from scratch, what are the steps we should have to take? What could a future without growth look like? Is there enough to go around? How will it be equitable?

________________________

[i] Oil is formed from phytoplankton that dies and sinks to the bottom of oceans. Coal is formed from ancient forests and biomass that is compressed and concentrated over time by pressure and heat.

[ii] The relationship between human labor potential and fossil fuel labor potential is simple to calculate. A barrel of oil contains 5,700,000 BTU, which translates to 1,700 kilowatt Hours (kWh) of work potential. This compares to around 0.6 kWh of energy metabolism per average adult human per 8 hour work day. Then 1760/0.6=2,933 days. Humans (in industrialized rich countries at least) work 5 days per week 50 weeks per year so if we divide 2,933 by 250 it works out to 11.7 years of human labor potential per barrel of oil. But humans are much more efficient at directing muscle work towards a task (think how much energy from gasoline pushing a car is dissipated as waste heat vs how much of your energy is directed towards pushing a wheelbarrow of soil). Using a conversion factor of 60%, this brings the 11.7 years of labor per barrel down to 4.7 years (rounded down to 4.5). Even this number could be high or low depending on the assumptions.

[iii] Each American uses about 57 barrels of oil energy-equivalent per year within the US, and another 14 barrels burnt in other countries, but consumed in products imported.

Comments